Operational update on development program

ASA, the developer of a proprietary Fischer-Tropsch technology that converts synthetic gas into fuel including sustainable aviation fuel (“SAF”) is pleased to provide an update

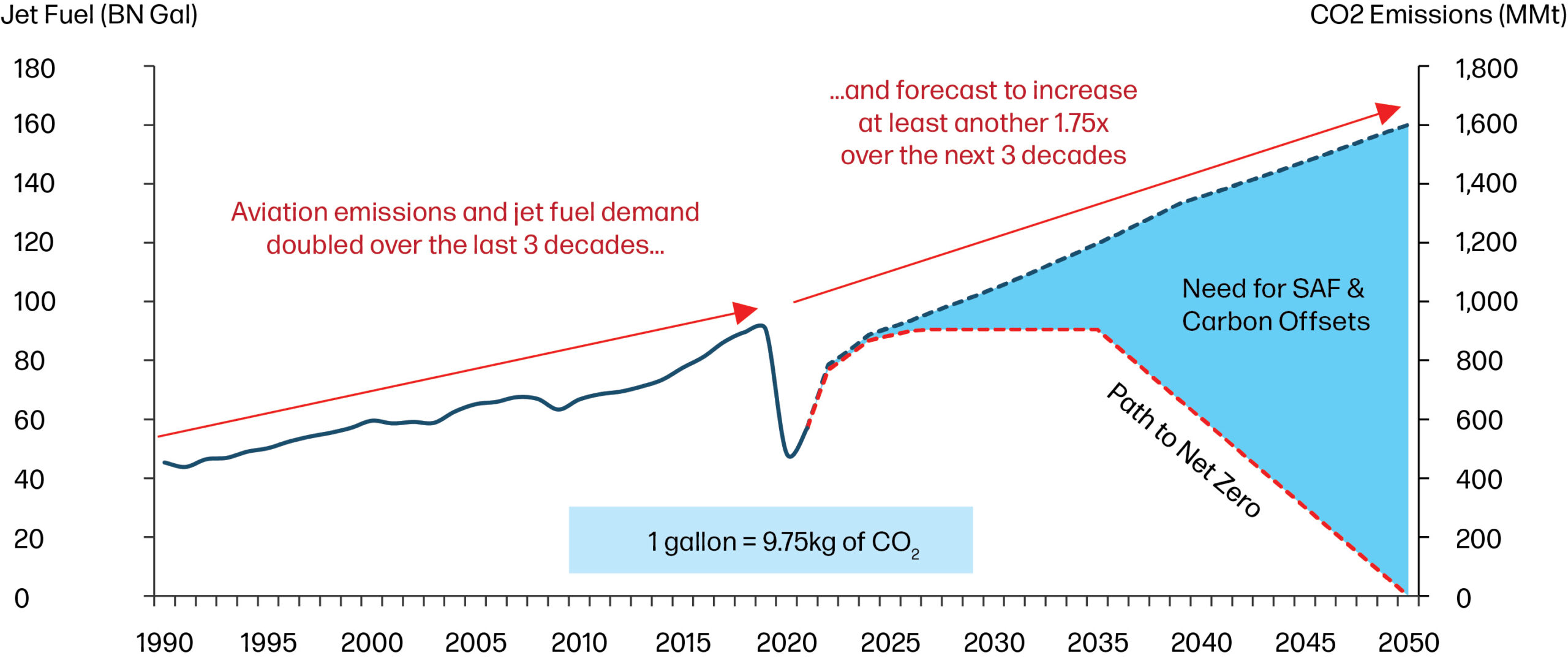

Aviation carbon dioxide emissions were 900 million tonnes in 2019. It is forecast that there will be 3.1% annual traffic growth in the period to 2050 and that there will be the need for 120 billion gallons of SAF for the aviation sector to achieve Net Zero by 2050.

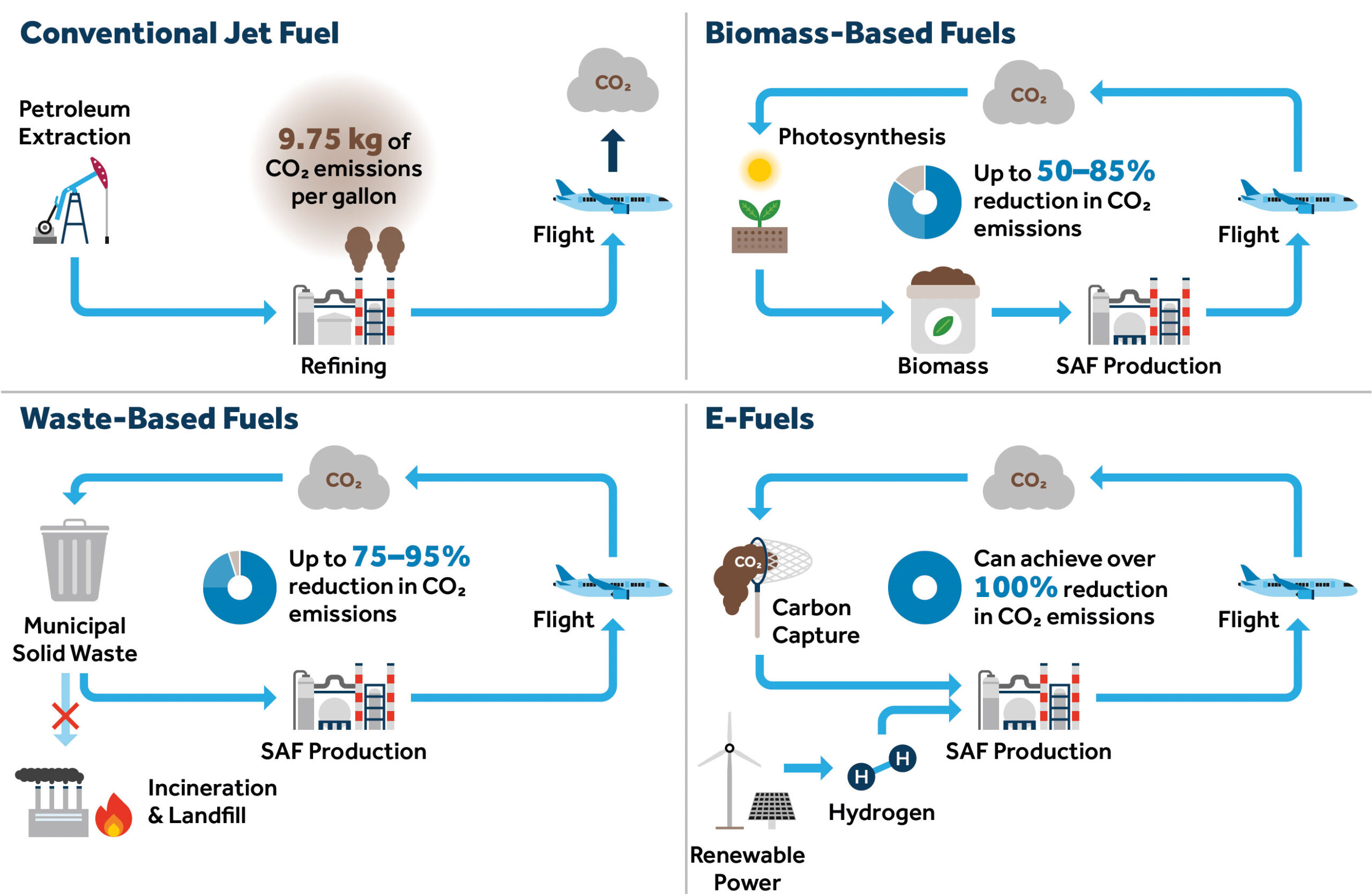

SAF can boast 75-95% lower life-cycle emissions versus conventional jet fuel by recycling biomass, waste, and captured carbon as its carbon feedstock. The use of biomass that has absorbed carbon dioxide from the atmosphere creates a carbon neutral cycle. In addition, the gasification of waste reduces the harmful impact on the environment of landfill (methane) gas. This can increase to 100% for E Fuels.

The iron and steel industry Iron and steel production accounts for circa 7-9% of global carbon dioxide emissions. Converting their waste gases into oil products with the potential addition of green hydrogen would improve their emission statistics.

Natural gas flaring generates circa 400 million tonnes of carbon dioxide emissions including un-combusted methane and black carbon.

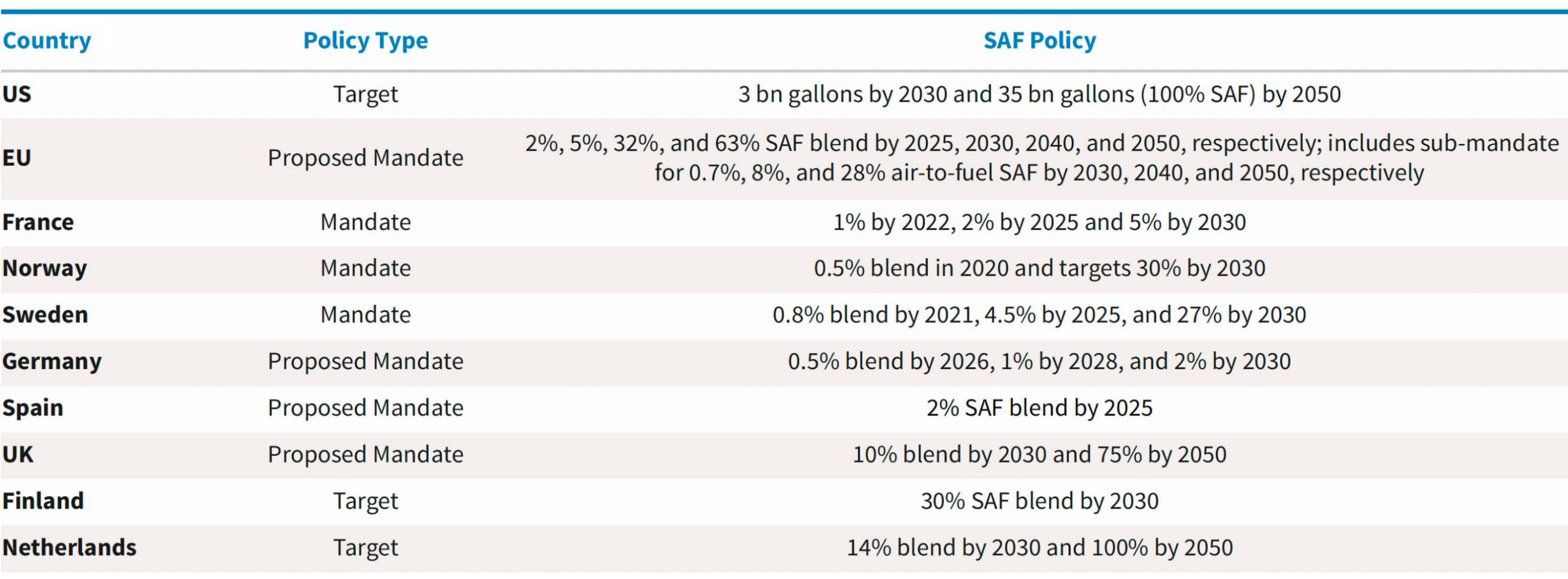

SAF blending mandates are spreading across Europe with a proposal for an EU-wide SAF blending requirement of 2% by 2025, escalating to 63% by 2050.

SAF Blending Mandates and Targets

In the US, the Inflation Reduction Act of 2022 has allocated US$245 million for SAF-related projects. This is mainly in the form of clean fuel production credits.

For 2023-2024, this equates to $1.00/gallon blenders tax credit for domestic biodiesel and renewable diesel production and $1.25-1.75/gallon blenders tax credit for domestic SAF production.

© 2022 ASA Energy Ltd

ASA, the developer of a proprietary Fischer-Tropsch technology that converts synthetic gas into fuel including sustainable aviation fuel (“SAF”) is pleased to provide an update